'Soft Brexit' Row Sees Sterling Rise, Gold Price in Pounds Near 6-Week Low as Eurozone GDP Hits 10-Year Best

GOLD PRICES in the global wholesale markets bounced $10 from an overnight drop to $1334 on Tuesday as Chinese demand held firm ahead of next month’s Lunar New Year and volatility in the currency markets switched to Sterling amid fresh wrangling over Brexit.

With 3 weeks until Chinese New Year – now the heaviest single period for household gold demand worldwide, beating India’s Diwali in recent years – wholesale gold prices in Shanghai held at a $8.40 premium to London quotes.

Rising from this month’s average so far, that was slightly below the typical incentive offered to new bullion imports into the world’s No.1 consumer nation.

“We continue to see interest on dips,” says a note on Asian trading from Swiss refiners MKS Pamp.

“However should further weakness become evident we are likely to stretch long [speculative] positioning and could see an extension [down] toward $1325 or even $1315.”

The Euro steadied around $1.24, more than a cent below last week’s new 3-year highs against the Dollar, even as new economic data said the 19-nation currency bloc expanded at the fastest pace in a decade in 2017, beating both the US and UK with annual GDP growth of 2.5%.

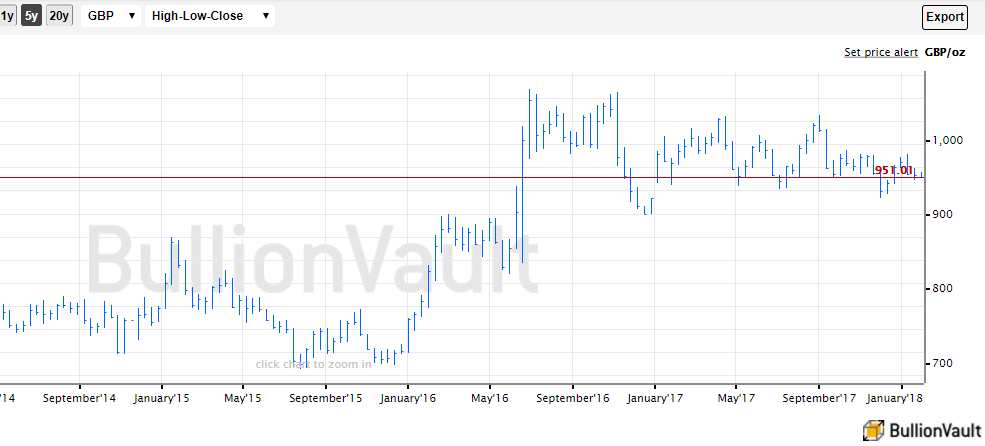

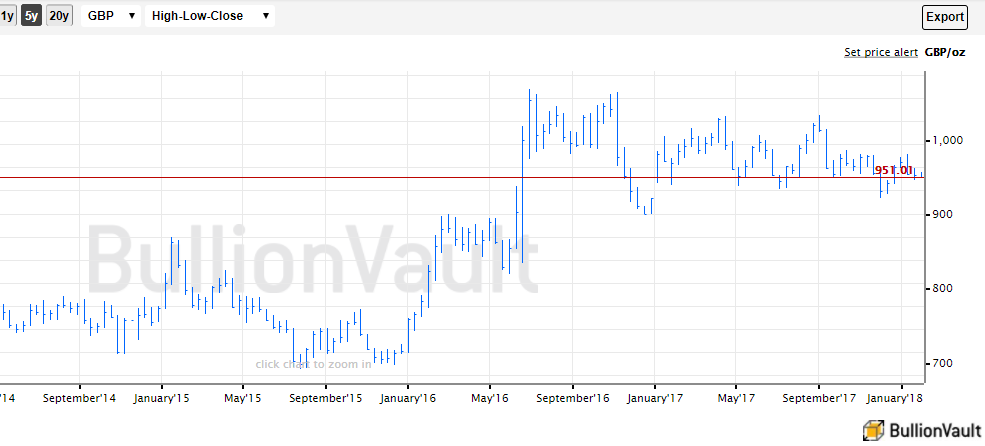

The UK gold price in Pounds per ounce meantime dipped briefly beneath £950, the 5-week low reached last Thursday, as Sterling rose further on an apparent shift towards a “soft Brexit” amongst lawmakers tasked with implementing mid-2016’s narrow referendum decision to leave the European Union.

For US Dollar gold prices “Resistance remains unchanged at $1267.30, the Aug 2017 High,” says the latest technical analysis from Canada’s Scotia Bank.

“Support is at $1329…[Momentum] is marginally bullish and remain biased to the upside.”

With a transition to Brexit scheduled to begin in March 2019, Prime Minister Theresa May’s proposed Bill for exiting the EU was today challenged in the upper chamber House of Lords, where pro-Remain Liberal Democrat Lord Newby said it “exhibits the arrogance and incompetence of the Government in equal measure”.

But he also said the Lib Dems have no plans to block the Bill or of “unnecessarily spinning out debate”.

A day after the EU’s General Affairs Council in Brussels took just 2 minutes to approve a post-Brexit deal giving the UK a “status quo transition without institutional representation” from March 2019 to end-December 2020 – widely called terms imposed on a “vassal state” today – news-site Buzzfeed today published details of an internal British government report saying that UK economic growth will suffer in any Brexit scenario, whether 2% lower over 15 years under a “soft Brexit”, 5% lower if a free-trade agreement is reached, or 8% lower under a “hard Brexit” default to World Trade Organization (WTO) rules for trading with its current EU partners.

British tabloid The Sun meantime published an interview with arch-Brexit lawmaker and current Government Trade Secretary Liam Fox calling for only “modest changes” in the UK’s long-term trading relationship with the rest of Europe.

Variously reported as “live with disappointment” and “LET REMAINERS WIN” by other British tabloids, Fox’s comments had been “misrepresented” he later said, urging that “We must be confident, positive and optimistic.”

Disclaimer

This publication is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. This report was produced in conjunction with ABC Bullion NSW.