Gold Prices Regain 'Key' 200-Day Moving Average After Weak US Jobs Data

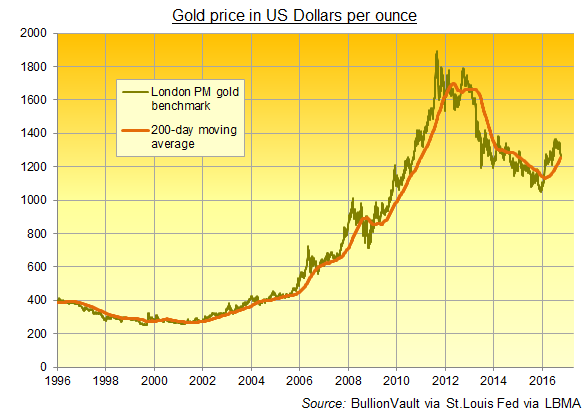

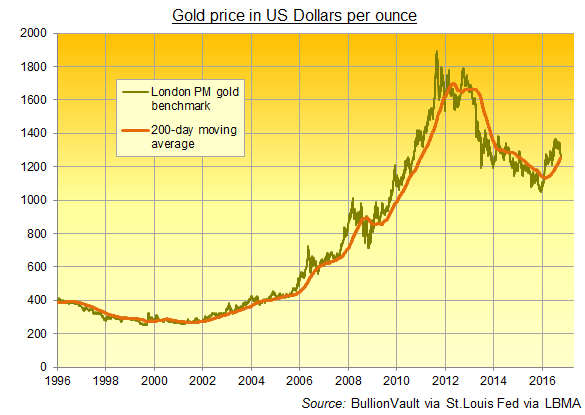

GOLD PRICED in US Dollars rose Friday back above its 200-day moving average – a ‘key’ technical level according to several analysts – after new US jobs data came in weaker than expected.

The US jobless rate rose to 5.0% in September according to the Bureau of Labor Statistics’ non-farm payrolls estimate, up one-tenth of a percent from the early 2008 lows reached this summer.

Gold prices rallied to $1261 following the news, $10 above the 4-month low hit as Asian trading began overnight with China still shut for the end of its National Day holiday week.

China’s Shanghai Gold Exchange will re-open Monday to find Dollar gold prices almost 5% below Friday last week.

Thursday saw the LBMA Gold Price auction – the global benchmark for physical bullion – fix below its 200-day moving average for the first time since February down at $1254.50 per ounce.

The average of gold’s previous 200 days proved solid support for the 125% gain from late 2008 to autumn 2011.

It then capped gold’s rallies during the last 12 months of its 45% bear market from 2011 to end-2015.

“Needless to say, our forecasts are currently under review,” says Dutch bank ABN Amro’s latest precious metals analysis, having turned bullish in February (when prices had gained 15% from December’s 6-year low) and then raising its price forecasts again in July (when prices hit a 2-year peak at $1375).

“[While] we expect the long-term uptrends to remain in place…gold prices need to bottom out around $1257 and silver prices around $17.10 per ounce, where the 200-day moving averages come in.

“If gold and silver prices break below these levels, this year’s uptrend is over.”

“Next major support is evident at $1258 per ounce,” agrees precious metals analyst Robin Bhar at French investment and bullion market-making bank Societe Generale in London – “the location of the influential 200-day moving average.

“Should this level be broken then this year’s uptrend could be in danger of unravelling.”

But “key will be whether this sell-off prompts bargain hunting and unleashes pent-up physical demand,” Bhar says, adding that while India’s festival and wedding season – peaking with Diwali at the end of October – will come after a slump in year-to-date demand, it also comes after an “above average” monsoon, likely boosting rural incomes.

“A lower gold price in Indian Rupee terms should also boost demand…[already] evidenced by a much narrower discount to [London wholesale] prices of $1-2 per ounce, compared with a [domestic Indian] discount as high as $75 in July.”

“Our recent visit to the trade fair in Delhi,” said this week’s precious metals note from specialist consultancy Metals Focus, “suggested a level of optimism for the remainder of this year.”

Rising consumer and investor demand will likely cushion gold’s fall, says a new note from US investment bank and bullion market-maker Goldman Sachs’ commodities chief Jeff Currie.

“We would view a sell-off substantially below $1250 as a strategic buying opportunity.”

Gold priced in Sterling meantime spiked more than 5% higher overnight as the Pound spiked down to fresh three-decade lows on the FX market at the start of Asian trading.

Hitting £1048 per ounce, gold priced in GBP then retreated but held above £1015 per ounce to show a small gain for the week and a 17% gain from June 23rd, Brexit Eve.

Disclaimer

This publication is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. This report was produced in conjunction with ABC Bullion NSW.