Gold Prices Fall vs Sterling, Moscow Equities Drop as UK-Russia Tensions Worsen

GOLD PRICES spiked to a 1-week high before retreating against a volatile US Dollar in London trade Wednesday as Russia promised retailiation over the UK expelling 23 diplomats as “undeclared intelligence officers” following the poisoning of a former spy with toxic nerve agent.

The UK also said it is tightening checks on Russian state-owned assets in Britian, and the Royal family will not attend this summer’s football World Cup, but it stopped short of announcing fresh financial sanctions against the No.2 gold mining nation.

Dropping from $1329 in Asia to stand in line with last week’s finish at $1323 by early New York trade, Dollar prices today marked the 10th anniversary of $1000 gold.

“We consider this hostile action as totally unacceptable, unjustified and shortsighted,” said the Russian Embassy in London of the UK Government’s action, putting “all the responsibility for the deterioration of the Russia-UK relationship [on] the current political leadership of Britain.”

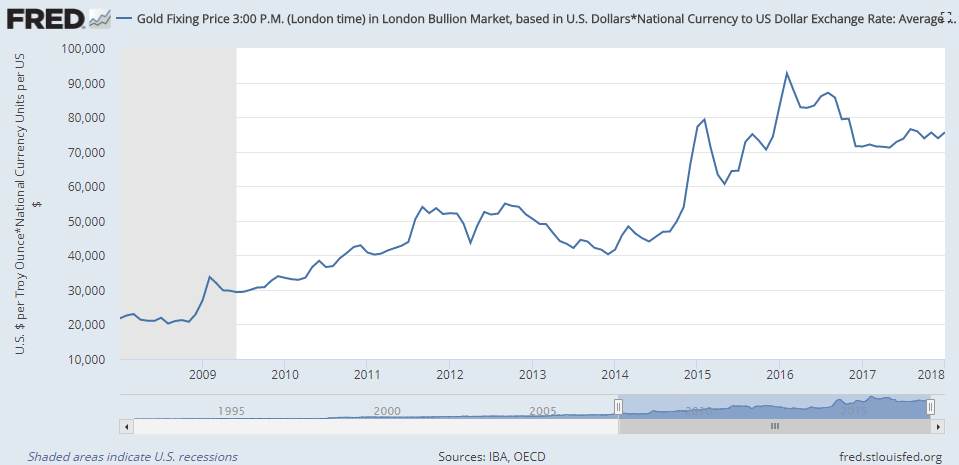

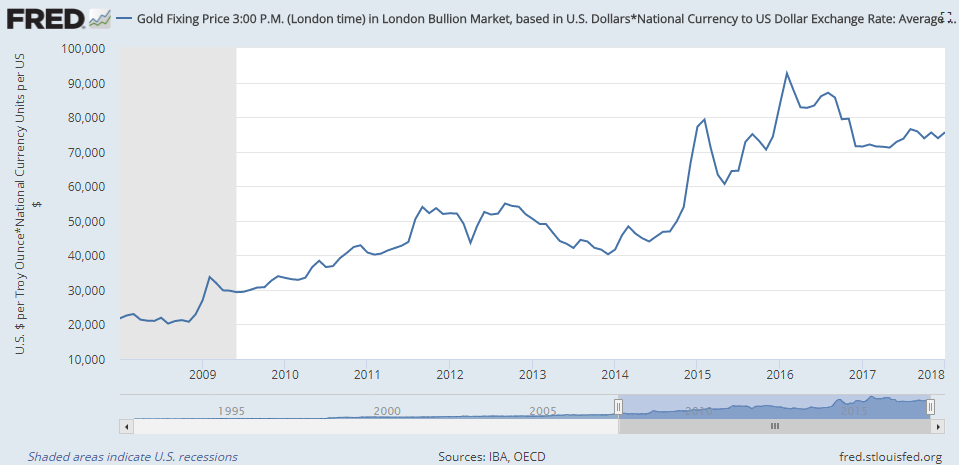

The Ruble fell today to 1-month lows against the British Pound, weakening by 12% from this time last year, while Russian gold prices held firm around RUB 75,000 per ounce as the currency weakened.

Russian gold prices set all-time record highs as the Ruble sank amid the wave of financial and personal sanctions imposed by the US and its European allies over Moscow’s annexation of former Russian territory Crimea and the conflict in Ukraine starting in 2014.

The UK gold price in Pounds per ounce meantime fell again to £946 on Wednesday, near its cheapest so far in March and £120 below the 3-year high hit on Britain’s shock EU exit referendum result in mid-2016.

London’s FTSE100 index of primarily international corporations held flat in Sterling terms, some 8% below January’s new all-time high.

Russia’s stock market fell hard for the day, but held within 3% of end-February’s new 10-year highs.

Platinum prices meantime fell steeply after touching 1-week highs above $973, erasing all of its gains from last Friday to trade back at $965 per ounce.

“Platinum closed above the 200-day moving average yesterday, and today crossed above the 100-day moving average,” says a technical trading note from Belgian refining group Umicore.

“If there are enough buyers, it might be possible to see further gains up to $982 or even up to $990.”

“Platinum recently took support at $941,” says a separate technical analysis from French investment and London bullion market-making bank Societe Generale, saying that level “represents the down-sloping trend drawn since 2014 highs.

“A move beyond $972 will mean a rebound towards $988 and even $998,” reckons SocGen’s team, pointing to “the upper limit” of a channel drawn on platinum’s hourly price charts.

Over in Frankfurt meantime today, “There is a very clear condition for us to bring net asset purchases to an end,” said European Central Bank chief Mario Draghi in a speech on quantitative easing and interest rates.

“We need to see a sustained adjustment in the path of inflation [up] toward our aim.”

“The ECB balance sheet keeps growing as Draghi continues buying bonds,” tweeted German new group Welt’s senior financial editor Holger Zschäpitz last week, noting how new data showed total assets at Eurosystem central banks reaching a fresh high of €4.5 trillion thanks to ongoing QE.

“The volume of the balance sheet now equals to 41.9% of Eurozone GDP vs 22.3% in the US.”

Disclaimer

This publication is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. This report was produced in conjunction with ABC Bullion NSW.