Gold Price Gives Back $10 Pop as Italy & Austria Votes Loom, Korean Won Rallies

GOLD PRICES fell back to last Friday’s 43-week closing low against the Dollar and most other major currencies in London trade Tuesday, dropping over 1% as European stock markets rose but government bond prices fell, nudging interest rates higher.

Gold prices in Shanghai had edged lower overnight as the Yuan strengthened from 8.5-year lows on the FX market.

But that clipped only $1 per ounce off yesterday’s 3-year record Shanghai gold premium, now some $23 over and above wholesale quotes for London settlement.

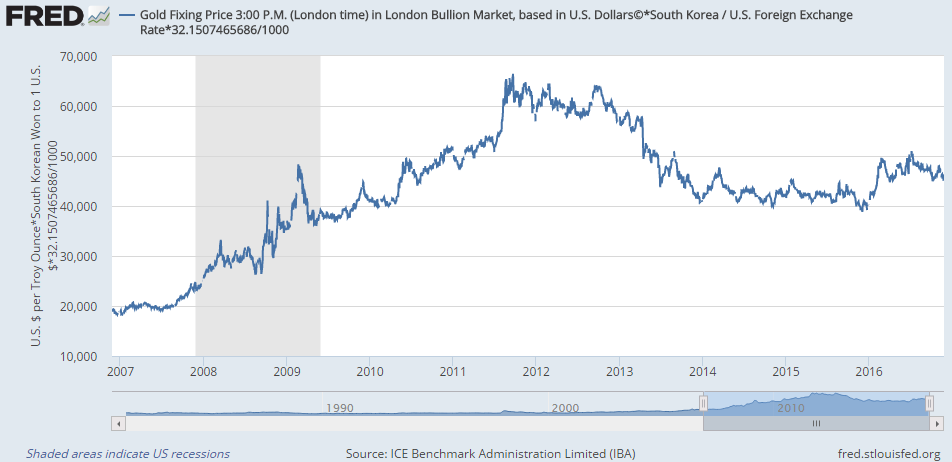

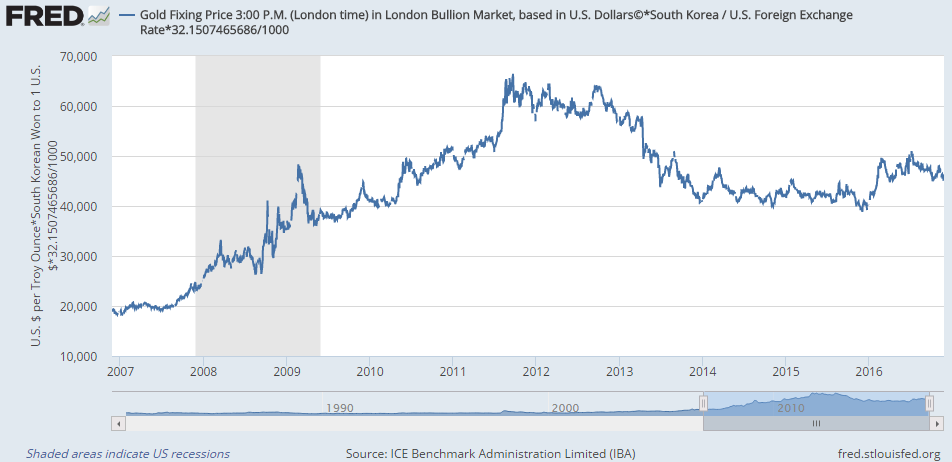

Embattled president of neighboring South Korea, Park Geun-hye today asked parliament to decide whether she should resign – 12 months before scheduled elections – over corruption allegations centered on her civilian advisor Choi Soon-sil.

The Won strengthened further from last week’s 5-month low, driving the gold price for Korean investors down to its lowest level since late January at KRW44,450 per gram.

Conservative Milan-based newspaper Corriere della Sera – Italy’s best-selling daily – meantime reported rumours from the Palazzo Chigi in Rome today that Prime Minister Matteo Renzi may resign even if he wins this weekend’s referendum on parliamentary changes, because his mandate from 2014 to reform Italy’s political institutions would then be complete.

Austria also goes to the polls Sunday, again in a tight race. Anti-immigration candidate Norbert Hofer of the Freedom Party denied in a TV debate last weekend that he wants an “Oexit” to follow the UK’s Brexit, but repeated he would push for a referendum to leave the European Union if Turkey joins.

The gold price in Euros today fell to touch €1116 per ounce, a level seen only once the UK voted to quit the EU in late June.

“Short term, a rebound looks likely,” says the latest gold-price note from technical analysts at French investment and bullion market-making bank Societe Generale.

But “a move beyond $1200/1207 remains needed…[after] gold tested [and failed at] resistance near $1330/1344” – currently where the downtrend from gold’s Dollar-price peak at $1920 of September 2011 comes in – on Donald Trump’s US election victory this month.

“[Gold] has [since] retraced towards earlier support near [that] multi-year [down] channel at $1172, where it has formed daily doji.

“This will be a key.”

With gold prices gaining $10 from $1183 yesterday only to give them back today, the giant SPDR Gold Trust (NYSEArca:GLD) ended Monday with the amount of gold bullion backing its shares unchanged from Friday, stemming 11 sessions of outflows from the major gold ETF investment vehicle, the longest stretch since gold’s spring 2013 price crash.

The largest silver ETF, the iShares IAU product, has meantime shed another 30 tonnes from the middle of last week, shrinking to its smallest size since July as prices extend their post-Brexit retreat to 23%, trading Tuesday at $16.46 per ounce.

Disclaimer

This publication is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. This report was produced in conjunction with ABC Bullion NSW.