Gold Price Erases Trump's Syria-Threat Spike as Russia Aims to 'Punch Stomach' of US-UK Alliance

GOLD PRICES failed to hold an overnight rally in London on Friday, dropping back to show no change for the week in Dollar and Euro terms as Moscow hit back at US sanctions and accused a “Russophobic campaign” of staging last weekend’s chemical attack on civilians in Syria.

Trading back at $1337 per ounce, the gold price in Dollars held over 2% below Wednesday’s spike to 20-month highs, made as US President Donald Trump threatened to strike against Syrian government forces despite Russian military support for the regime.

Refusing to give the UK Parliament a vote on airstrikes, prime minister Theresa May is now “waiting for instructions from Donald Trump” alleged opposition Labour Party leader Jeremy Corbyn today, urging against “escalating an already devastating conflict” in Syria by targeting Russia’s ally Bashar al-Assad for the attack in Douma.

The town fell overnight to Assad’s forces, says a report on Al-Jazeera, giving the regime full control of the former rebel enclave of Eastern Ghouta.

The US President himself meantime hit back at ex-FBI director James Comey’s new book – including fresh claims over the “pee tape” allegedly used by the Kremlin to blackmail Trump – calling Comey an “untruthful slime ball”.

The Moscow stock market held onto this week’s rally, halving last week’s 10% plunge following US sanctions over Russia’s alleged role in the poisoning of an ex-spy in the British city of Salisbury.

The Russian Ruble also held its 5.5% rally from Wednesday’s spike to 17-month lows versus the Dollar.

World stock markets meantime extended their gains, taking the Euro Stoxx 50 index 1.6% higher from last Friday’s finish.

The Euro currency held 2 cents shy of February’s 3-year high against the Dollar, holding the gold price for investors in No.4 consumer nation Germany at €1085 per ounce.

Priced in the British Pound in contrast, gold showed a 0.9% loss for the week down at £937 per ounce, a 3-week low.

Since Donald Trump’s inauguration in January 2017, the gold price in Dollars has now risen 11.8% and gained 16.8% against the Ruble – currency of the world’s No.2 gold mining nation.

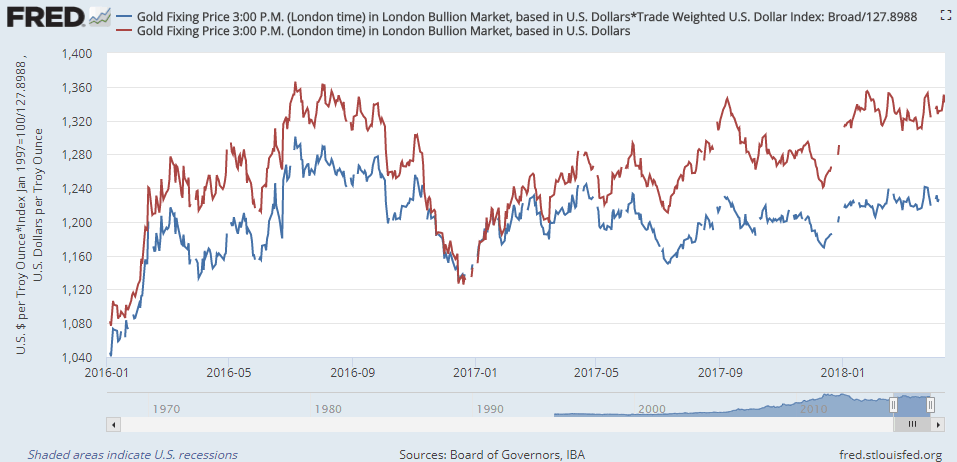

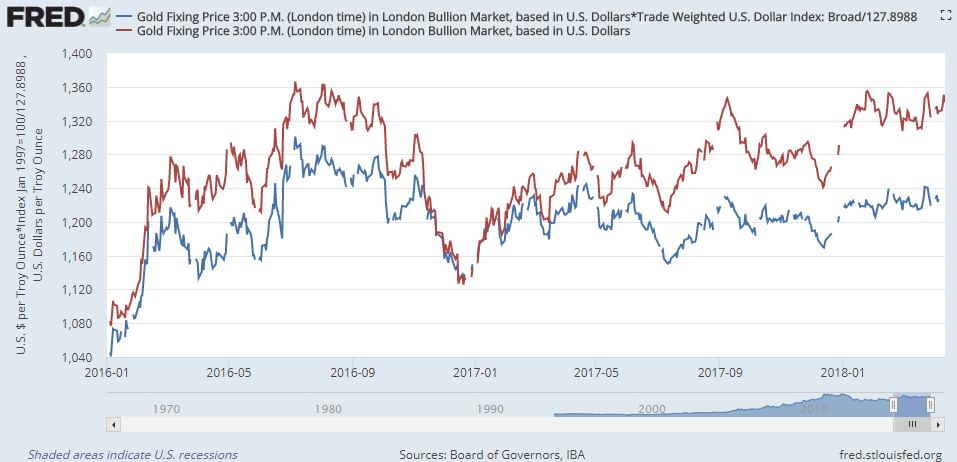

Adjusted for the Dollar’s trade-weighted value on the currency markets, in contrast, the non-US gold price has risen only 2.6%.

Trading at the equivalent of just $1227 per ounce, the non-Dollar gold price today held more than $100 lower than the US price.

Moscow has “irrefutable information that [the Douma chemical weapons attack] was another fabrication,” claimed Russian foreign minister Sergey Lavrov today.

A draft bill going to the Duma next week will allow Russian companies to infringe US trademarks in what one senior politician called “a punch to the stomach [of] the domination of the Anglo-Saxon and Western world…ensured precisely by the right of intellectual property.”

Other proposals in what State Duma speaker Vyacheslav Volodin called “tit for tat” retaliation “respond[ng] to the boorish behavior by the US” include banning the sale of titanium to aircraft manufacturer Boeing.

With estimates earlier this week saying that the 50 Russian tycoons named by US sanctions last Friday had already lost $12 billion on a plunge in the value of their assets, the top 3 “may have lost a combined $7.5bn” over the last week according to Reuters’ data today.

Disclaimer

This publication is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. This report was produced in conjunction with ABC Bullion NSW.