GOLD PRICES rose against a weakening Dollar in London trade Tuesday, regaining last week’s 0.5% loss to reach $1329 per ounce but slipping in Euro and Sterling terms as talk of a “trade war” between the US and Europe grew.

The Japanese Yen also pulled back on the FX market, outpacing the retreat in the Dollar and helping gold prices erase most of last week’s 2.0% plunge for Tokyo investors.

World stock markets rose meantime, following Wall Street’s overnight gains, but major government bond prices fell, pushing longer-term interest rates higher.

UK and

German bond yields both rose over 5 basis points on 10-year debt, reaching 1-week and 2-week highs that stood one-third and two-thirds higher respectively from the level at this point in March 2017.

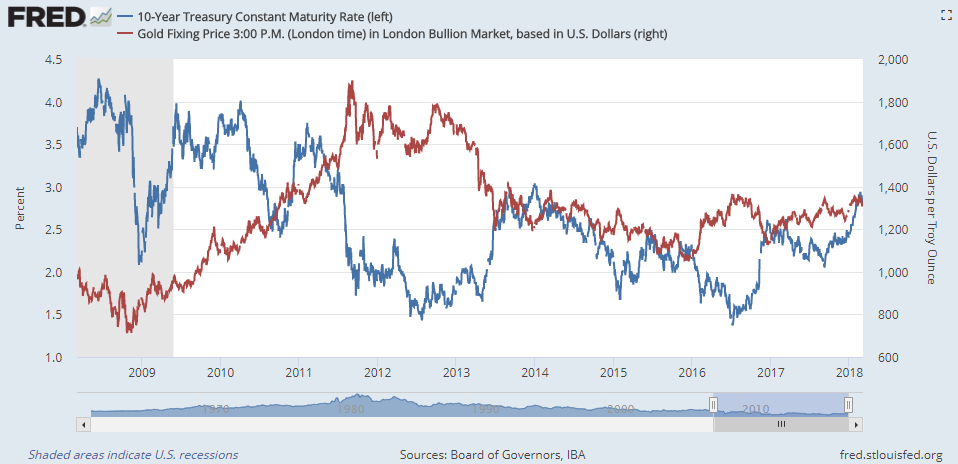

Ten-year US Treasury yields rose to 2.90% for the fifth time in 3 weeks – a four-year high when reached in mid-February.

The last time 10-year US yields were higher than today, gold priced in the Dollar stood $100 lower per ounce.

On Monday the European Union handed its 28 member states a list of 100 US imports – worth around $3.5bn per year – it says could face higher taxes or tariffs, including Bourbon, jeans, corn, steel and motorbikes.

“This is just a hair’s breadth away from a no-rules trade war,” the

Financial Times today quotes a US expert on World Trade Organization rules.

Set to vote on

a post-Brexit trade deal for the UK next week, the European Parliament meantime sent its chief co-ordinator Guy Verhofstadt to London today to meet UK negotiator David Davis, saying that Britain must get beyond what he called the “vague aspirations” stated in Prime Minister Theresa May’s much-heralded speech last Friday.

Facing calls for a general election after the murder of an investigative journalist and his partner, the Prime Minister of EU and Eurozone member Slovakia meantime accused the country’s President of conspiring with Hungarian hedge-fund manager George

Soros to destabilize his government.

Thousands of Czechs in Prague protested Monday against the appointment of

a former riot-squad chief who reportedly used water cannon, dogs and clubs against 1989 pro-democracy parades as head of the country’s police complaints body.

Defeated Italian prime minister Matteo

Renzi meantime resigned as leader of the center-left PD party following the weekend’s election results, which split power between a Eurosceptic right-wing coalition and the Eurosceptic anti-establishment 5-Star Movement.

“The resulting uncertainty will presumably contribute to solid demand for gold,” reckons a bullion-market note from German financial services group Commerzbank.

Gold priced in Euros however slipped again on Tuesday, re-touching last week’s 1-month lows beneath €1070 per ounce.

The gap between Italian and German bond yields also retreated, dropping back from Monday’s spike to around 1.4 percentage points on 10-year debt.

Commodity prices rose Tuesday, taking Brent crude oil up towards 2-week highs above $66 per barrel.

Silver prices rallied harder than gold, rising against all major currencies and recovering $16.61 per ounce – a level last seen before new Federal Reserve chief Jerome

Powell hinted at more US interest-rate hikes than expected in 2018 in testimony to Congree last Tuesday,