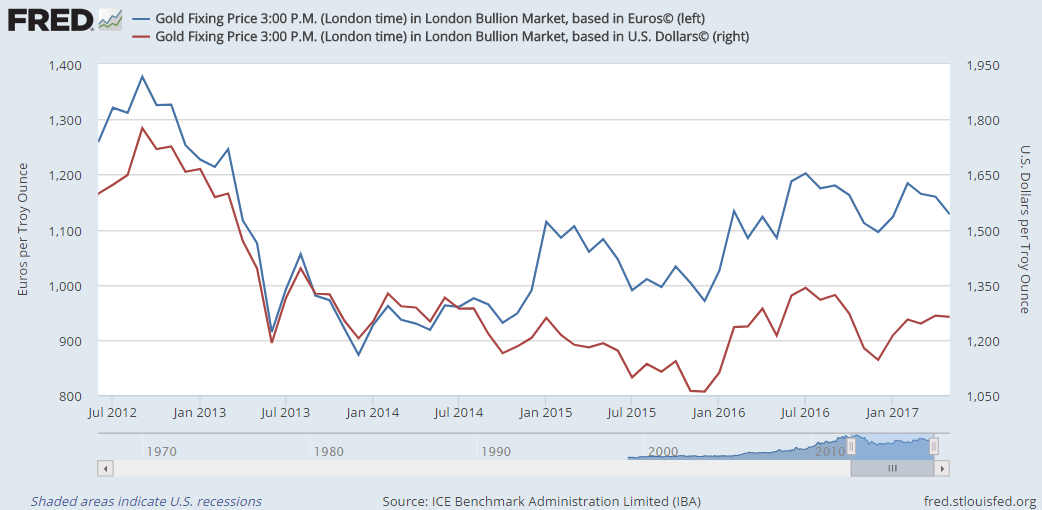

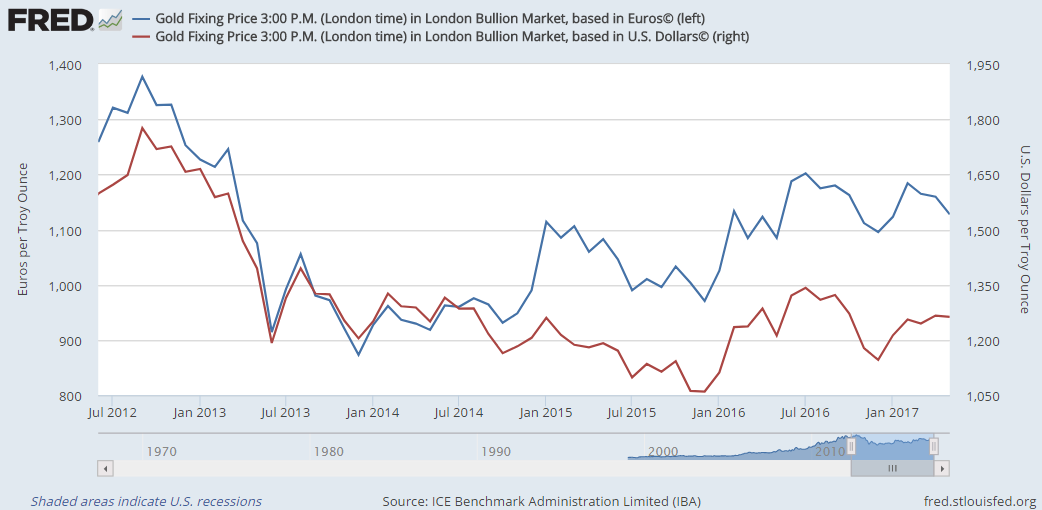

GOLD PRICES in London’s wholesale market erased their monthly loss against a falling US Dollar on Wednesday, reversing May’s earlier 4% drop as world stock markets rose once again.

Rising back to end-April’s Dollar level of $1266, gold traded in wholesale bullion bars had fallen to 8-week lows in mid-May at $1214 per ounce.

Priced in the single-currency Euro in contrast, gold headed Wednesday for a 3% loss for May, nearing its lowest monthly close since January at €1129 per ounce.

“Transatlantic relations are of paramount importance,” said German Chancellor Angela Merkel to reporters today,

apparently seeking to calm speculation over her comments following last week’s fraught meeting with US President Donald Trump that “we have to take our destiny in Europe into our own hands.”

“We have a MASSIVE trade deficit with Germany,”

Trump meantime tweeted, “plus they pay FAR LESS than they should on NATO & military. Very bad for US. This will change”

“The last time there was disagreement on this scale, especially on trade,” notes Chinese bullion bar clearing bank ICBC Standard’s FX strategist Stevem Barrow, “was arguably just under 30 years ago.

“Back then US Treasury Secretary James Baker went on the offensive over German policy.

The result, in many people’s eyes, was the stock market crash of October 1987.”

With barely 1 week until the UK’s snap General Election meantime, the British Pound fell further from mid-May’s 8-month highs after

a “controversial” forecast from pollsters YouGov was splashed on the front page of The Times, predicting a “possible” hung Parliament despite the ruling Conservatives showing

a 12-point lead.

Hitting $1.30 on 18 May, Sterling today dipped below $1.28 – its lowest level in 5 weeks – helping buoy the gold price for UK investors at last week’s closing level near £990 per ounce.

That was a 3-year high when first hit in the immediate aftermath of last June’s

Brexit referendum vote to leave the European Union.

An outright win by Prime Minister Theresa May’s Conservative Party is now

priced at 5/1-on according to the latest gambling odds from bookmaking exchange Betfair, down from 11/1-on this time last week.

The FTSE100 index of mostly global-operating but London-listed companies rose again Tuesday, taking its gains since the Brexit vote to 23%.

Accounting for the Pound’s 9% fall versus the Euro single currency however, the EuroStoxx 50 index has risen 1.5x as fast, gaining over 34% in Sterling terms.

New York’s S&P500 index has risen 31% for UK investors.