Gold Bars Go to $6 Premium in China as Yuan Hits Fresh 6-Year Lows on Capital Outflows

GOLD BARS traded in London’s wholesale market steadied against the rising US Dollar Friday, heading for a solid weekly gain versus all major currencies as the Chinese Yuan hit fresh 6-year lows on the FX market.

Premiums for gold bars settled in Shanghai ended the week $6 per ounce above comparable London quotes, well over twice the typical incentive to new imports of bullion to the world’s No.1 consumer market.

World stock markets meantime stalled while energy prices rose and major government bond prices ticked higher, but the rate of interest offered by Germany’s 10-year government debt continued to hold above zero.

That extended to 2 weeks the longest period of positive Bund yields since they first broke below zero just before the UK’s Brexit referendum on quitting the European Union in late June.

Gold bars meeting trade body the LBMA’s Good Delivery standards rose to €1162 per ounce Friday, almost recovering summer 2016’s post-Brexit floor, lost a fortnight ago.

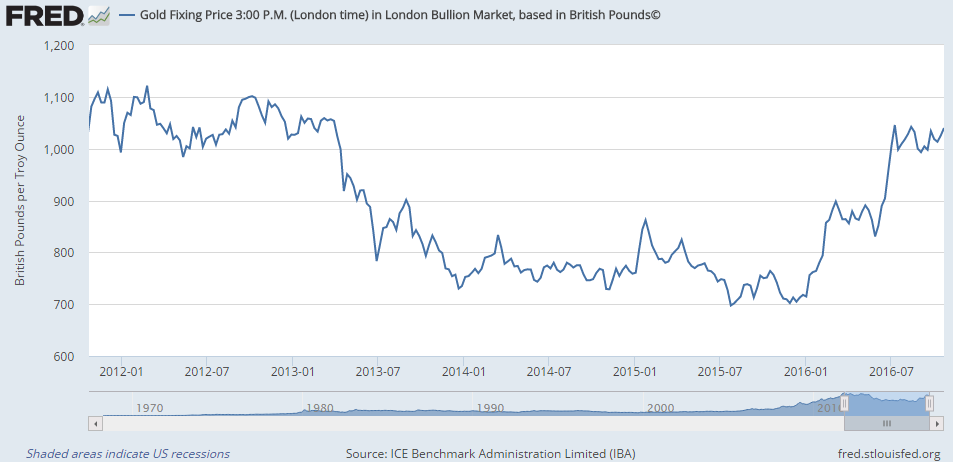

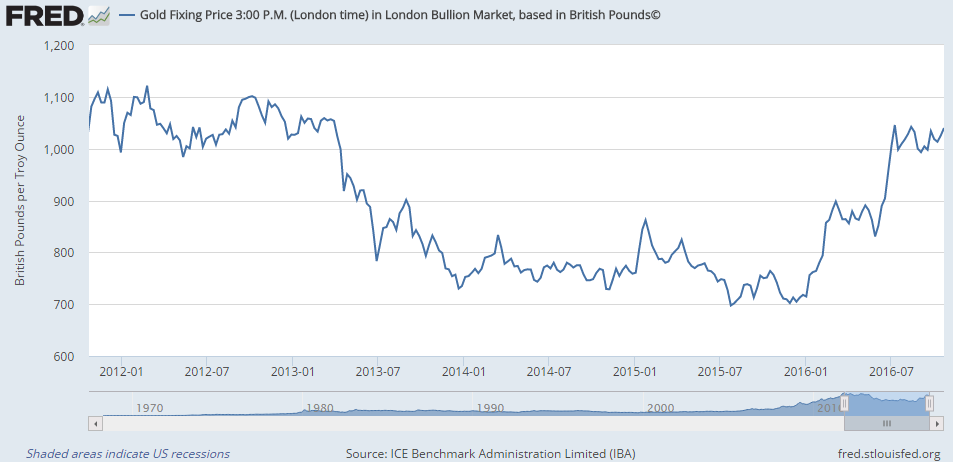

Gold priced in British Pounds meantime rose just shy of £1040 per ounce, nearing its third highest weekly close of the last 3.5 years.

“[The falling Yuan] is the key global story to focus on, not the Pound,” says French investment and bullion bank Societe Generale’s global strategist Albert Edwards.

“With the Chinese economy set to slow noticeably over the next six months as the authorities restrain yet another housing bubble, it is the global deflationary impact of a weak Renminbi that we need to watch closely.”

Outbound transfers of Chinese Yuan “surged to a record in September” says Bloomberg News today, quoting official Beijing data today showing a net outflow worth almost $45 billion.

The most since Beijing’s SAFE department for FX management began reporting in 2010, that jumped 60% from August and cannot be explained by trade flows according to US investment bank and London bullion market-maker Goldman Sachs, suggesting capital flight by investors.

“Depreciation concerns have re-emerged,” reckons economist Tommy Xie at Oversea-Chinese Banking Corp. in Singapore. “Worry [is] that China will allow higher volatility after SDR inclusion, which is actually happening now.”

SDRs – meaning Special Drawing Rights – are an international accounting and FX reserves unit for central banks.

Delayed from January 2015, and cutting the British Pound’s share of the SDR basket by 30%, the Chinese Yuan was added to the basket’s other components of Dollars, Euros and Yen at the end of September.

Last month’s fresh 6-year lows in the Yuan saw gold bullion bars imported to China and Hong Kong from the key refining point of Switzerland fall sharply from September 2015, new data said Thursday.

Swiss bullion flowed most into the UK – more typically an exporter to Switzerland of large gold bars, then converted into high-grade kilobars for the Asian investment and jewelry fabrication markets.

Friday morning saw global spot quotes for London settlement fall 0.7% in Dollar terms from early Thursday, but Yuan prices on the Shanghai Gold Exchange slipped only 0.2%.

That drove the benchmark Shanghai Gold Fix – at which bars are offered and bid at a range of prices until buying and selling come into balance – up to a $6 per ounce premium over London, even as the Yuan reached new 6-year lows on the FX market.

The Yuan has now lost over 10% of its Dollar value since end-2013’s two decade high.

Disclaimer

This publication is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. This report was produced in conjunction with ABC Bullion NSW.